The Strategic

Plan

Reaching your financial goals isn't just about getting there—it's about getting there smarter. Maximize your financial potential with expert guidance that evolves with your life.

Why the Strategic Plan?

The Strategic Plan maximizes your financial potential and accelerates progress toward every goal. Whether you're building wealth, seeking financial independence, or planning for the future, you'll receive a step-by-step roadmap that factors in your unique financial situation.

For Parents and Couples

With our experts, design and implement strategies that maximize your family’s financial future.

For Rising Professionals

Build wealth and optimize cash flow, as you advance in your career.

For Business Owners

People who need help balancing personal and business finances, including retirement planning for themselves and employees, tax optimization, and succession planning.

For Employees with Equity

Rely on us to maximize stock options and RSUs with tax efficient strategies.

For Real Estate Owners

Strategic planning to make the most of your real estate investments.

For High Earners

Expert guidance and efficient wealth management solutions to optimize your income.

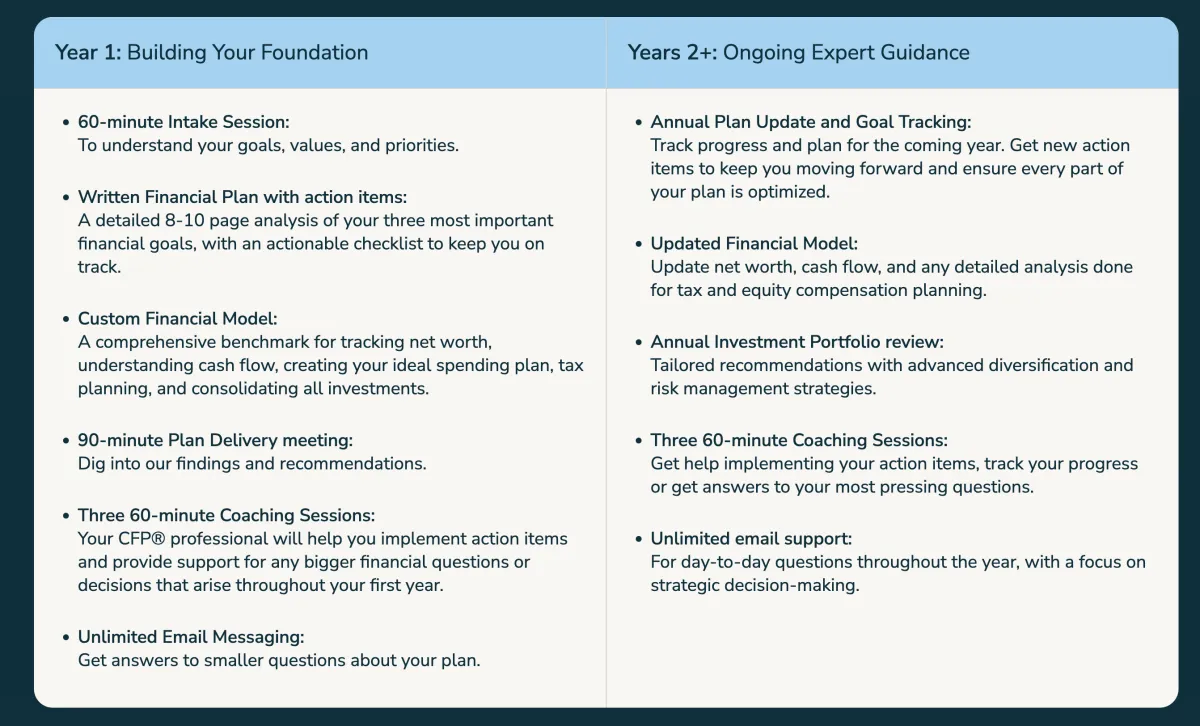

How It Works

Turn your financial dreams into reality, one step at a time.

Step 1

We start with a deep dive into your priorities and goals, to understand what matters most.

Step 2

From spending to taxes to investments, we analyze everything that touches your financial life.

Step 3

We create a detailed, step-by-step action plan that helps you reach your goals, and works for your life.

Step 4

Your dedicated CFP® professional is always available to help keep you on track, and adjust your plan as life unfolds.

Topics covered

Get expert analysis across the areas that matter most and find new ways to make your money start working harder for you.

Goal setting

Prioritize your financial goals and create a system for making trade-offs

Establish realistic timelines and assess feasibility

Cash Flow Analysis

Review income sources and spending patterns

Develop a 12-month spending plan

Optimize cash returns

Establish emergency savings

Plan for major expenses

Tax Planning

Maximize tax-advantaged accounts for optimal growth

Identify potential deductions and credits

Strategically use tax-loss harvesting to keep more money working toward your goals

Investments

Detail analysis of current investments and asset allocation

Get recommendations based on goals and risk tolerance

Diversification strategies for concentrated positions

Equity Compensation

Optimize your RSU/ESPP strategy through a personalized schedule

Navigate complex stock options with tax-efficient plans for your NSOs and ISOs

Get tax projections to minimize tax burden when selling

Retirement Savings

Maximize 401(k) and IRA strategies

Calculate required savings for retirement and/or financial independence

Consolidate and align retirement assets

Real Estate Planning

Home purchase affordability analysis

"Keep vs. Sell" analysis of your current home

Analyze investment properties to evaluate potential acquisitions

Boost rental property income by identifying strategies to increase profitability

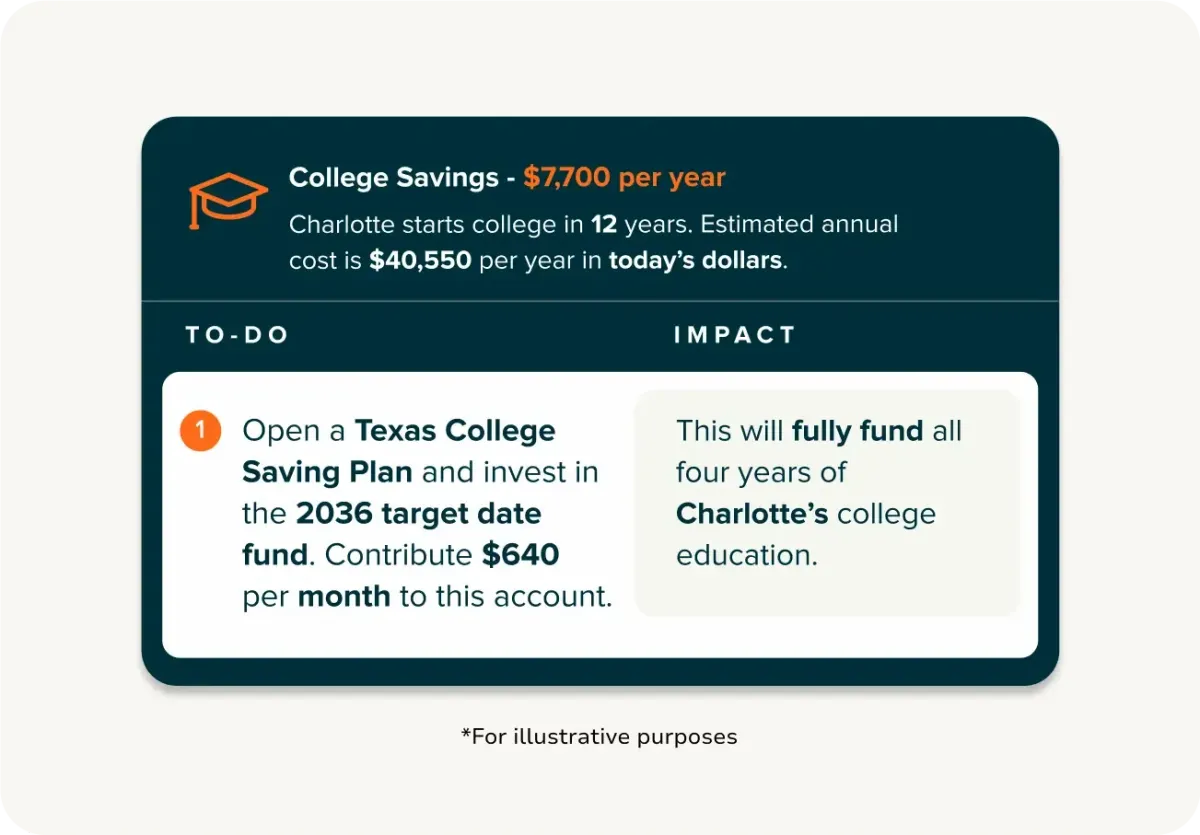

Education Savings

Calculate funding goals for different college scenarios

Choose the best type of account to fund education goals

What you get

PRICING

STRATEGIC

$4,800

Flat fee per year

Best For

Rising professionals, employees with equity compensation, and those building wealth.

What's Included:

8-10 page financial plan with detailed action items

Tax planning and optimization

Equity compensation strategies

Real Estate planning

Education funding strategies

4 coaching sessions with your dedicated CFP® professional

Domain’s 100% Satisfaction Guarantee

Get Domain Money and if you don't love it, we’ll give you your money back!

Your Dedicated CFP® Professional

The partnership that maximizes your financial potential

Your CFP® professional becomes your trusted financial partner; understanding your goals, adapting to life's changes, and keeping your money aligned with what matters most. We build a relationship based on expertise and genuine care for your financial wellbeing.

This personalized partnership provides peace of mind through every financial decision point and milestone in your life, allowing you to focus on what you truly enjoy while remaining confident your financial future is in expert hands.

Copyright © 2026 Cardone Wealth Advisors, All Rights Reserved.

Cardone Wealth Advisors, an investment advisor registered with the U.S. Securities and Exchange Commission. By using this website, you accept and agree to Cardone Wealth Advisors Terms of Use and Privacy Policy. Cardone Wealth Advisors’ financial planning and Investment advice available to residents of the United States and is only provided to customers of Cardone Wealth Advisors. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The information contained in them is not, and shall not constitute financial, investment, legal, or tax advice, an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Investing comes with inherent risks and you should always invest within your means and risk tolerance. Past performance is not an indication of future returns and you should always consult a financial advisor prior to making investment decisions. Please refer to Cardone Wealth Advisors’ Program Brochure for important additional information.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.